What are the costs and coverage of Medicare Part D

Medicare Part D plays a crucial role in providing prescription drug coverage to Medicare beneficiaries. However, it’s essential to understand the costs associated with Part D and the coverage it offers. In this comprehensive guide, we’ll explore the various aspects of Medicare Part D costs, including premiums, deductibles, and copayments. We’ll also delve into the coverage gap and other important considerations. So let’s dive in and demystify the world of Medicare Part D costs and coverage.

What is Medicare Part D?

Medicare Part D is a prescription drug plan offered by private insurance companies approved by Medicare. It is designed to help Medicare beneficiaries afford their necessary medications. Part D plans vary in terms of covered drugs, premiums, and copayments, allowing beneficiaries to choose a plan that best suits their needs.

How does Part D work?

Medicare Part D operates through a network of private insurance plans. Beneficiaries can enroll in a standalone Part D plan, which works alongside Original Medicare, or they can choose a Medicare Advantage plan that includes prescription drug coverage (MA-PD). These plans have different costs and coverage levels, so it’s crucial to understand the specifics of each plan before enrolling.

Medicare Part D costs

When considering Medicare Part D coverage, it’s important to understand the various costs associated with the program. These costs include monthly premiums, annual deductibles, copayments or coinsurance, costs in the coverage gap, and potential penalties for late enrollment.

Monthly premiums

Medicare Part D plans require beneficiaries to pay a monthly premium to maintain coverage. The specific premium amount can vary depending on the chosen plan. On average, the national premium for Part D plans is $32.74, but it’s important to note that premiums can be higher for individuals with higher incomes.

Annual deductibles

Part D plans may have an annual deductible, which is the amount you must pay out of pocket before the plan starts covering your medications. The deductible amount can vary based on the plan you choose. In 2023, the maximum deductible allowed is $505 for individuals who do not qualify for Extra Help. However, individuals with full Extra Help may have a $0 deductible, while those with partial Extra Help may have a deductible of $104 or the plan’s standard deductible, whichever is lower.

Copayments or coinsurance

In addition to premiums and deductibles, Part D plans require beneficiaries to pay copayments or coinsurance for their medications. The specific amount can vary depending on the plan and the tier of the drug. Most plans have different copayments or coinsurance amounts for generic drugs, preferred brand-name drugs, non-preferred brand-name drugs, and specialty drugs.

Costs in the coverage gap

The coverage gap, also known as the “donut hole,” is a temporary limit on what Part D plans will cover for prescription drugs. Once you and your plan have spent a certain amount on covered drugs, you enter the coverage gap. In 2023, the coverage gap begins after you and your plan have spent a total of $4,660 on covered drugs. During this gap, you are responsible for paying 25% of the cost of your medications.

Costs with Extra Help

Extra Help is a program that provides financial assistance for individuals with limited income and resources. If you qualify for Extra Help, your copayments or coinsurance for prescription drugs will be significantly reduced. The specific cost-sharing amounts depend on your level of Extra Help and can vary. For example, if you have full Extra Help, your copayments for generics and brand-name drugs will be $4.15 and $10.35, respectively, until you reach catastrophic coverage. Once you reach catastrophic coverage, your costs will be reduced to $0 for the rest of the calendar year.

Late enrollment penalty

If you don’t enroll in a Part D plan when you are first eligible and go without creditable prescription drug coverage for 63 consecutive days or more, you may be subject to a late enrollment penalty. The penalty is calculated by multiplying 1% of the national base beneficiary premium by the number of full months you were eligible for Part D coverage but did not enroll. This penalty is added to your monthly premium for as long as you have Part D coverage.

Factors affecting Part D costs

Several factors can influence the costs associated with Medicare Part D. These factors include the prescription drug formulary, drug tiers, drug benefit phases, preferred pharmacies, and Extra Help with costs.

Prescription drug formulary

Each Part D plan has a specific list of covered drugs known as a formulary. The formulary outlines the drugs that the plan will cover and the associated copayments or coinsurance amounts. Before enrolling in a Part D plan, it’s essential to review the formulary to ensure that your necessary medications are covered.

Drug tiers

Part D plans categorize drugs into different tiers based on their cost and coverage level. Typically, generic drugs are placed in lower tiers and have lower copayments, while brand-name and specialty drugs are placed in higher tiers with higher copayments or coinsurance amounts. Understanding the tier placement of your medications can help you estimate your out-of-pocket costs.

Drug benefit phases

Medicare Part D has different phases that impact your drug costs throughout the year. These include the initial coverage period, the coverage gap, and catastrophic coverage. Each phase has different cost-sharing requirements. It’s important to understand which phase you are in and how it affects your out-of-pocket costs for medications.

Preferred pharmacies

Part D plans often have preferred and non-preferred pharmacies within their network. Choosing a preferred pharmacy can result in lower out-of-pocket costs for your medications. Before selecting a Part D plan, consider whether your preferred pharmacy is included in the plan’s network.

Extra Help with costs

As mentioned earlier, Extra Help is a program that provides financial assistance for Medicare beneficiaries with limited income and resources. If you qualify for Extra Help, your copayments or coinsurance for prescription drugs will be significantly reduced. To determine if you are eligible for Extra Help, you can visit the Medicare website or contact your local Social Security office.

New insulin benefit

To address the rising costs of insulin, Medicare has introduced a new benefit for Part D beneficiaries. Starting in 2023, the cost of a one-month supply of each Part D-covered insulin is capped at $35. This cap applies regardless of the drug benefit phase you are in and exempts you from paying a deductible for insulin. If you choose to obtain a 60- or 90-day supply of insulin, your costs cannot exceed $35 per month’s supply of each covered insulin.

This new insulin benefit aims to make insulin more affordable for Medicare beneficiaries and ensure access to this essential medication.

Managing Part D costs

When facing high prescription drug costs, there are several strategies you can employ to manage your Part D expenses effectively.

Consult with your doctor

If the cost of your medications is becoming a burden, it’s essential to discuss this with your healthcare provider. Your doctor may be able to prescribe lower-cost alternatives that are equally effective. By exploring different options, you can potentially save on out-of-pocket costs throughout the year.

Consider lower-cost alternatives

In addition to consulting with your doctor, it’s worth considering lower-cost alternatives for your medications. Generic drugs, for example, are typically more affordable than their brand-name counterparts and can provide the same therapeutic benefits. By exploring different drug options, you may find cost savings without compromising your health.

Utilize drug price dashboards

To gain more insight into drug prices and manufacturers’ pricing practices, you can utilize drug price dashboards. These online tools provide information on drug price increases, trends, and other relevant data. By understanding the market dynamics, you can make more informed decisions regarding your prescription drug choices.

Additional financial assistance

For individuals with limited income and resources, there are additional programs that can provide financial assistance to help cover Medicare Part D costs.

Medicare savings programs

Medicare Savings Programs, offered by states, assist eligible individuals in paying for their Medicare Part A and/or Part B premiums. These programs can help alleviate the financial burden associated with healthcare costs. To determine if you qualify for a Medicare Savings Program, you can contact your local Medicaid office or visit the Medicare website for more information.

Extra Help for prescription drug costs

As previously mentioned, Extra Help is a program that provides financial assistance specifically for Medicare prescription drug coverage. Depending on your income and resources, you may qualify for full or partial Extra Help. This assistance can significantly reduce your copayments or coinsurance for prescription drugs, making medications more affordable. To determine if you are eligible for Extra Help, you can contact the Social Security Administration or visit the Medicare website.

2023 Medicare Part D costs

Understanding the specific costs associated with Medicare Part D in 2023 is crucial for beneficiaries. Below is an overview of the expected costs for the upcoming year.

Premiums

Medicare Part D plan premiums vary depending on the plan you choose. The national average premium for 2023 is $32.74. However, it’s important to note that premiums can differ based on your location and the specific plan you select. Individuals with higher incomes may also have higher Part D premiums.

Deductibles

Part D plans may have an annual deductible, but the maximum deductible allowed in 2023 is $505 for individuals who do not have Extra Help. Those with full Extra Help are exempt from paying a deductible, while individuals with partial Extra Help may have a deductible of $104 or their plan’s standard deductible, whichever is lower.

Copayments or coinsurance with Extra Help

For individuals who qualify for Extra Help, the copayments or coinsurance for prescription drugs are significantly reduced. The specific cost-sharing amounts depend on the level of Extra Help. For those with full Extra Help, copayments for generics and brand-name drugs are $4.15 and $10.35, respectively. Once catastrophic coverage is reached, the cost for each drug is reduced to $0 for the rest of the calendar year. Individuals with partial Extra Help may have different cost-sharing amounts based on their specific plan.

Annual notice of change

Each year, Medicare Part D plans must send beneficiaries an Annual Notice of Change (ANOC) that outlines any changes to the plan for the upcoming year. This includes changes to premiums, deductibles, copayments, and covered medications. It’s essential to review this notice carefully to understand how your plan may change and how it will impact your costs.

Understanding plan changes

The ANOC provides valuable information about any changes to your Part D plan. It’s crucial to review this document to understand how your costs may be affected. Pay close attention to changes in premiums, deductibles, and copayments, as well as any modifications to the list of covered medications.

Plan premiums and deductibles

The ANOC will clearly state any changes to your plan’s premiums and deductibles. It’s important to note that your plan cannot change your deductible or premium during the plan year. However, any changes for the upcoming year will be outlined in the ANOC. Review these changes carefully to ensure you are aware of what to expect in terms of costs.

Choosing a Medicare Part D plan

When selecting a Medicare Part D plan, it’s crucial to compare the costs and coverage options available to you. Here are some key considerations when choosing a plan.

Comparing plan costs

When comparing Part D plans, consider the premiums, deductibles, and copayments associated with each plan. Additionally, review the formulary to ensure that your necessary medications are covered and that the copayments or coinsurance amounts are reasonable. By comparing the costs and coverage options, you can select a plan that aligns with your healthcare needs and budget.

Contacting plan providers

Once you have narrowed down your options, it’s a good idea to contact the plan providers directly to gather more information. Reach out to the customer service departments of the plans you are interested in and ask specific questions regarding costs, coverage, and any other concerns you may have. This will give you a better understanding of each plan and help you make an informed decision.

Conclusion

Understanding the costs and coverage of Medicare Part D is essential for Medicare beneficiaries who rely on prescription medications. By familiarizing yourself with the premiums, deductibles, copayments, and coverage gap associated with Part D, you can make informed decisions when choosing a plan. It’s also important to explore potential financial assistance programs, such as Extra Help and Medicare Savings Programs, to help alleviate the financial burden of prescription drug costs. Remember to review the Annual Notice of Change each year to stay informed about any changes to your plan. To find out which plans cover your drugs can be found on the federal government website www.medicare.gov. By taking these steps, you can navigate the complexities of Medicare Part D and ensure that you have access to the medications you need at an affordable cost.

Sources

- How Much Does Medicare Part D Cost? – NerdWallet

- Costs for Medicare drug coverage – Medicare

- Medicare Part D drug plan costs

Medical Disclaimer

NowPatient has taken all reasonable steps to ensure that all material is factually accurate, complete, and current. However, the knowledge and experience of a qualified healthcare professional should always be sought after instead of using the information in this page. Before taking any drug, you should always speak to your doctor or another qualified healthcare provider.

The information provided here about medications is subject to change and is not meant to include all uses, precautions, warnings, directions, drug interactions, allergic reactions, or negative effects. The absence of warnings or other information for a particular medication does not imply that the medication or medication combination is appropriate for all patients or for all possible purposes.

Related Articles

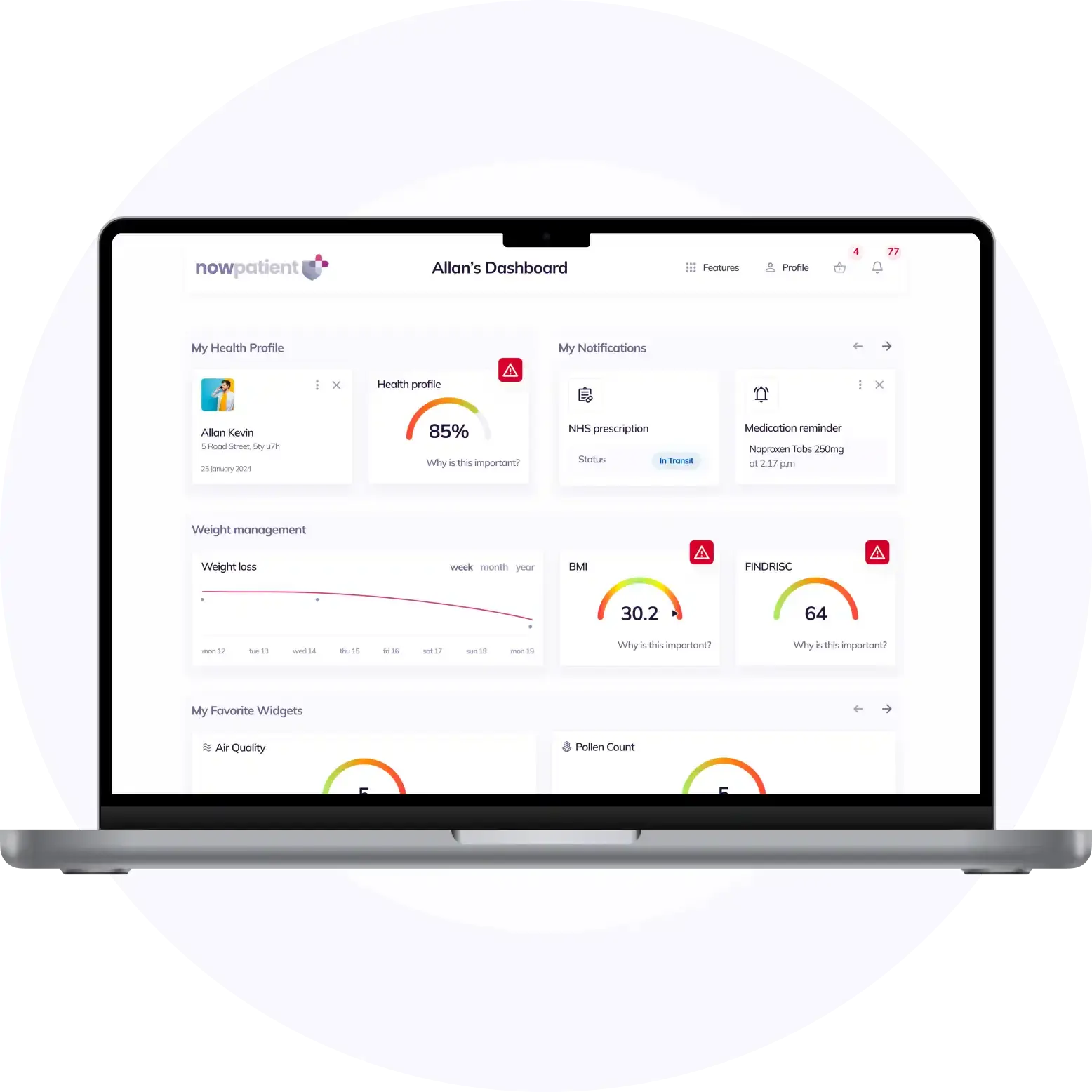

What is NowPatient

Telehealth and Online Pharmacy

NowPatient is a licensed online pharmacy and doctor service that is available around the world. Our service is FREE and packed with valuable features that can benefit your health such as medication reminders, educational blogs, medically approved symptoms checker, UK NHS online pharmacy, private treatment plans, Rx Advantage card, health conditions information, affordable medications options, genetic testing, home test kits, health risks, pollen meter, air quality monitor, weight loss plans, drug savings programs and lots more!

WHY WE BUILT NOWPATIENT

To improve the lives of everyone by making high-quality care accessible and convenient

We are here to improve lives. Our service gives you access to smart features and resources that can help empower you to take control of your health and improve your health outcomes. All this, in one place, for FREE. We strive to bring a fresh perspective to managing health. NowPatient can be accessed by downloading the App or using your web browser.

Download our app today

Can I trust NowPatient

Meet our medical team

We are a passionate group of clinicians and medical writers covering a broad range of specialities with experience operating in health systems in the United Kingdom & United States. Providing excellent care and advice is at the heart of everything we do. You can read more about our medical team by visiting the medical team page or learn more about how we curate content by visiting our editorial process